Mexc New York

Table of Contents

Have you ever wondered which cryptocurrency exchange offers the deepest market liquidity? Well, look no further! In this article, we will take a closer look at MEXC, the exchange that has been turning heads with its impressive market depth and liquidity.

Unveiling MEXC’s Impressive Market Depth

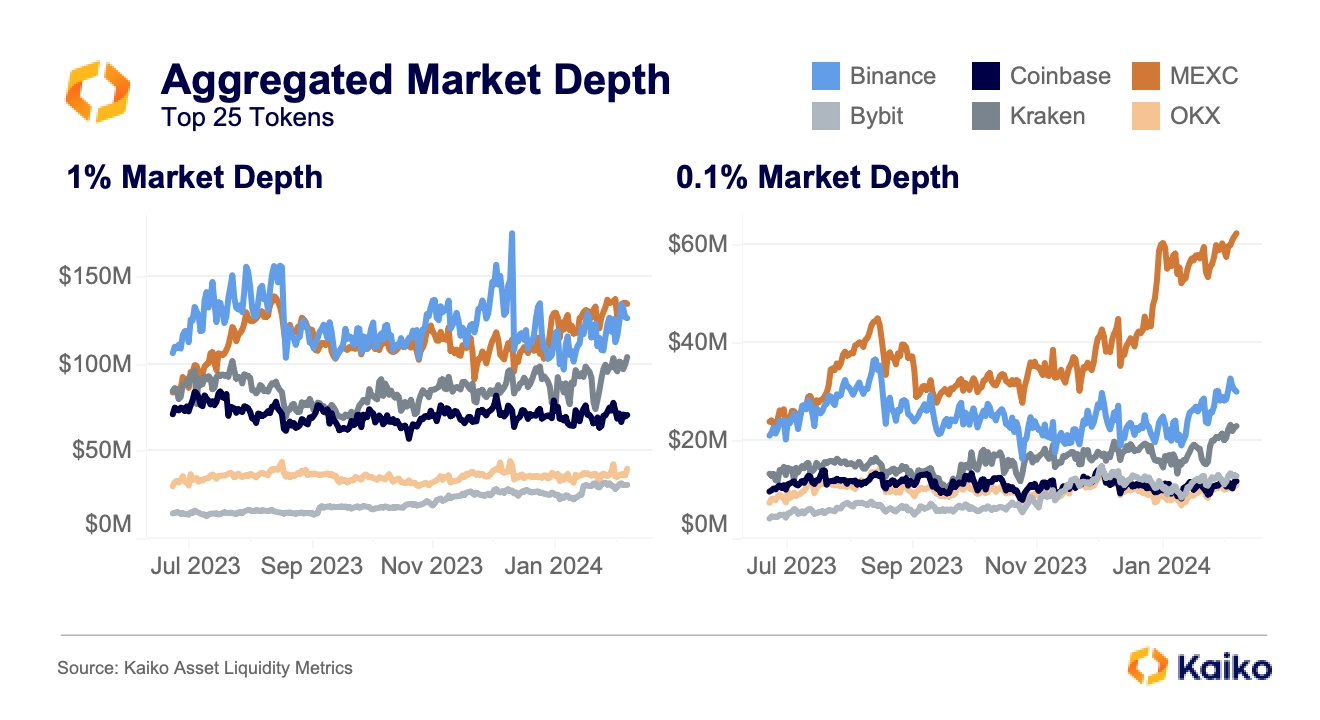

MEXC, known as the World’s Deepest Exchange, boasts an astounding 1% market depth, rivaling even the likes of Binance. In fact, MEXC has more than doubled Binance’s market depth of 0.1% in just three short months. This surge in liquidity is even more notable considering the current premium attached to liquidity in the market.

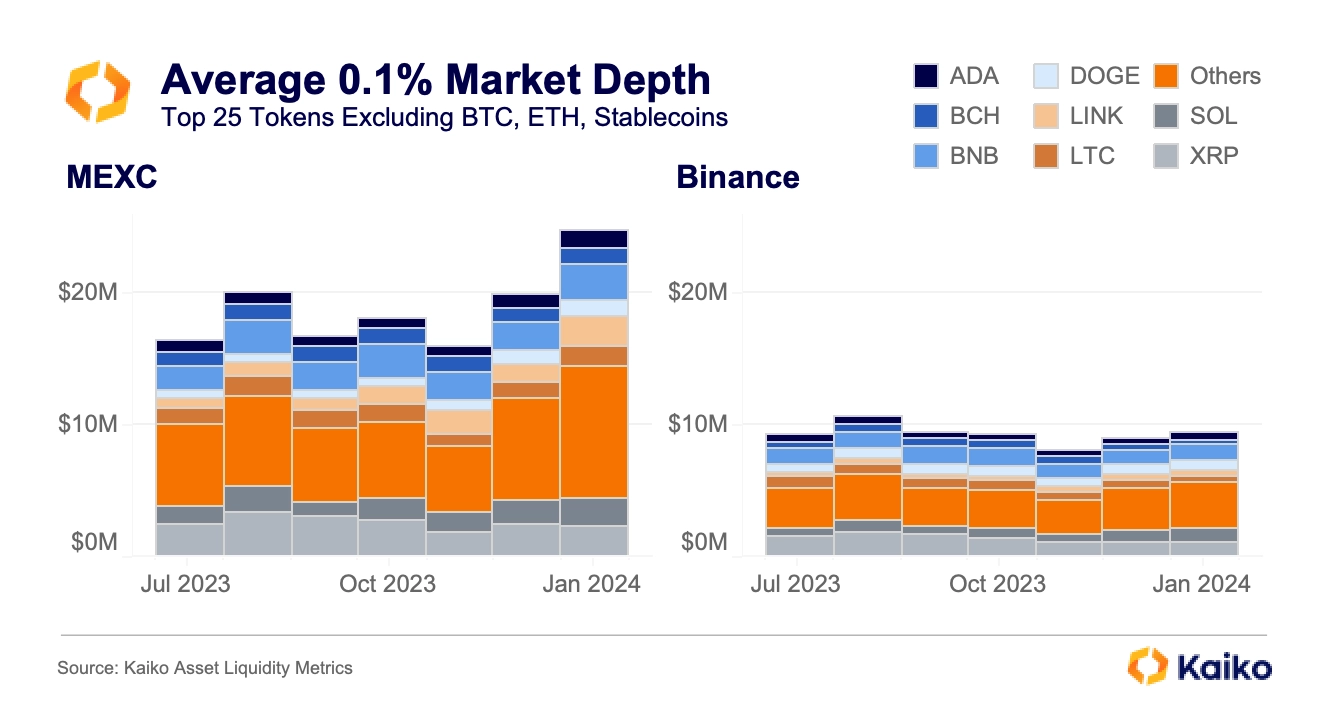

To put things into perspective, let’s compare the monthly average 0.1% market depth for altcoins between Binance and MEXC.

According to the data, MEXC’s market depth for tokens like BNB is nearly three times that of Binance. However, it’s crucial to consider the overall trading volume as well. Binance has consistently outperformed MEXC in terms of trading volume, with over $900 billion compared to MEXC’s $100 billion since September.

The Liquidity Ratio: Unveiling the Mysteries

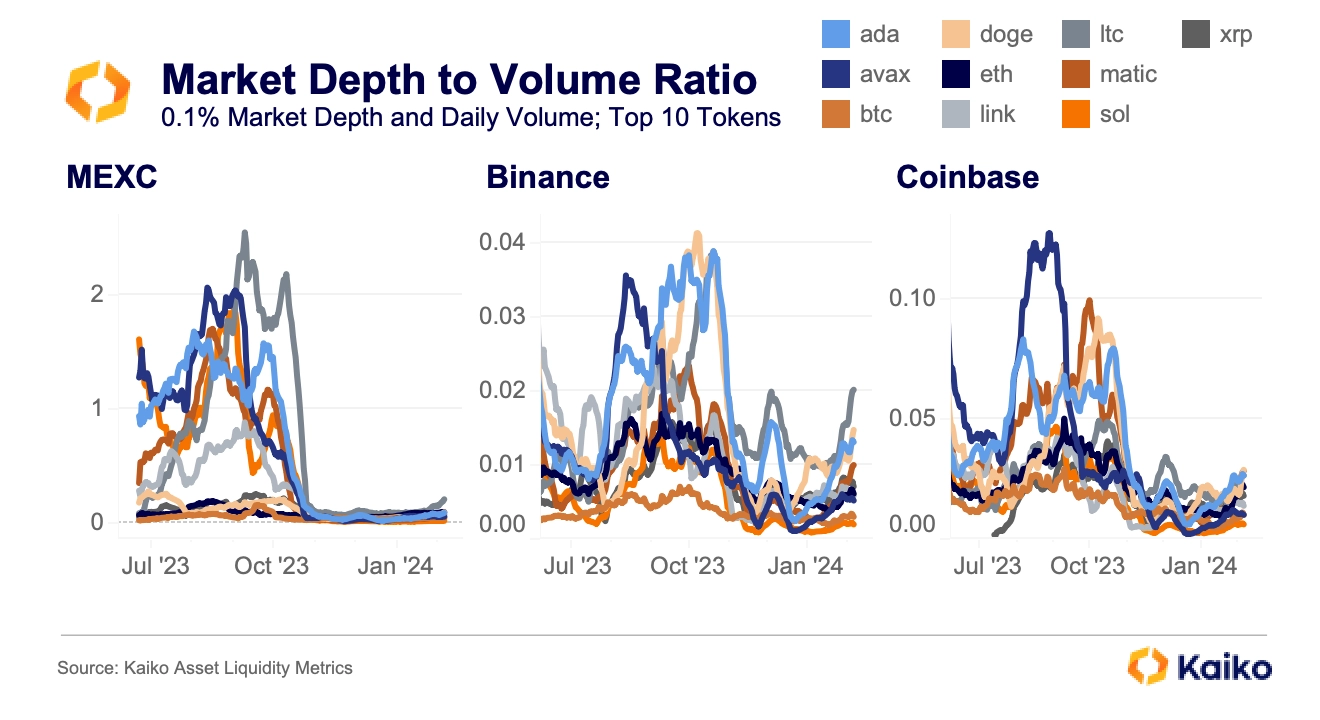

To further examine the liquidity scenario, we can delve into the market depth-to-volume ratio, which reveals the liquidity of an asset relative to its trading volume. Higher values indicate more liquidity and lower trading volume, while lower values indicate the opposite.

When we analyze MEXC’s data, it becomes evident that it falls short in comparison to giants like Binance or Coinbase. While Binance maintained a ratio below 0.04, and Coinbase touched 0.15, MEXC’s median ratio since September 2023 stands at a staggering 0.22, surpassing even Kraken, which comes in second with a ratio of 0.11.

Anomalies and Familiar Patterns

Coinbase, Kucoin, and Bybit are among the exchanges that follow MEXC in terms of liquidity, but there are some interesting patterns that raise questions. Take HTX and Poloniex, for example, two exchanges where suspicious trading activities have been identified. These exchanges exhibit absurdly low liquidity ratios of 0.004 and 0.001, respectively.

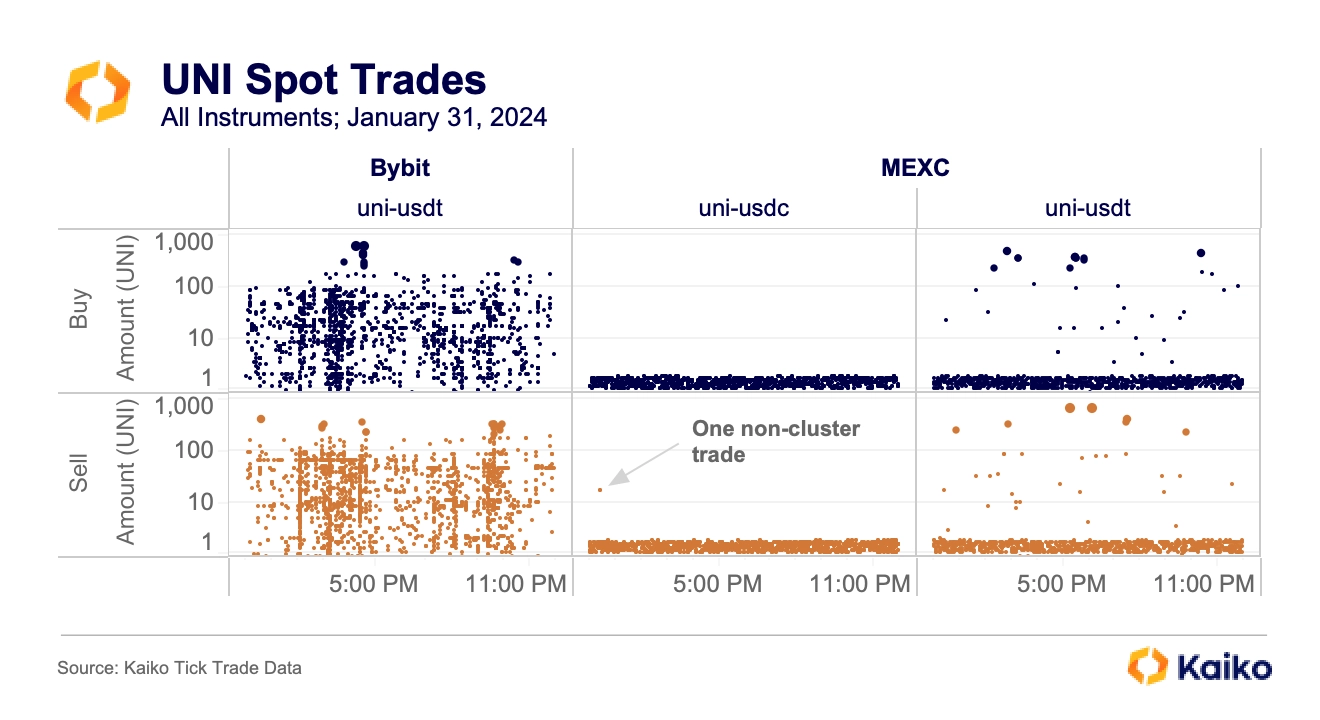

As we delve deeper into MEXC’s trading patterns, we stumble upon some intriguing similarities. On January 31, 2024, MEXC showcases a consistent pattern in nearly every UNI trade, with trades ranging between 1.1 UNI and 1.9 UNI. These “cluster” trades account for a whopping 98.5% of MEXC’s UNI-USDT trades and 20% of its total trading volume. Similar patterns can be observed across various other instruments, such as the BNB-USDC pair, where only 3% of trades have been non-cluster trades since the start of February.

Conclusion: Investigating the Unusual

MEXC has undeniably emerged as the most unusual exchange in recent months. Its market share growth has been matched by an amplified liquidity story. While some exchanges have previously attempted to manipulate the 2% market depth metric, MEXC’s dominance lies closer to the mid-price range, with tight yet volatile spreads. With zero spot maker and taker fees and relaxed KYC requirements, the source of the suspicious volume patterns remains uncertain. It is crucial to investigate such anomalous data and consider the simplest explanation.

Rest assured, MEXC was excluded from the Q4 Token Liquidity Ranking, highlighting its unique position in the market.

In conclusion, MEXC stands out as an exchange with impressive market depth and liquidity. Although questions remain about the source of its liquidity, its position as one of the world’s deepest exchanges cannot be denied.

[1] Kraken’s high ratio is due to the numerous instruments per asset it offers, whereas MEXC has a more limited range of instruments for each asset.

[2] For further insight into our coverage, please refer to the Q4 Token Liquidity Ranking.

So, if you’re looking for a deep and liquid crypto exchange, MEXC is definitely one to keep an eye on!